Small Company under Companies Act 2013

Meaning of Small company and the related benefits / relaxation provided to it with updated definition […]

Read MoreAnnual Information System under Income Tax

Concise information about – New Annual Information System to replace the Form 26AS.

Read MoreCost of Inflation Index (CII)

Sl. No. Financial Year Cost Inflation Index (1) (2) (3) 1 2001-02 100 2 2002-03 105 […]

Read MoreTaxation on Mining of Bitcoins (Cryptocurrency)

Introduction Cryptocurrencies are decentralised, virtual, or digital currencies which are neither backed by any Government nor […]

Read MoreBudget 2022

Highlights related to Income tax amendments applicable via the Budget 2022 announced on 01.02.2022

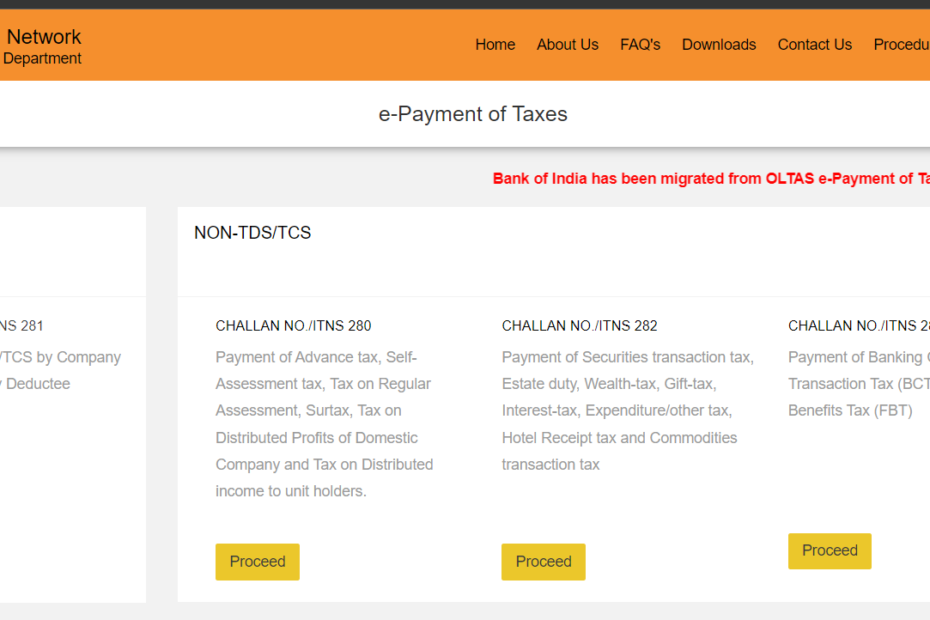

Read MoreAdvance Tax Payment Procedure

Step # 1: Visit the website https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp Step # 2: Select CHALLAN NO./ITNS 280 Step # […]

Read MoreSmall Company – Updated Limits

Notification No G.S.R. 700(E) Dated 15th September, 2022 The Ministry of Corporate Affairs has revised the […]

Read MoreProfession Tax Karnataka – Chages w.e.f 01.04.2023

Highlights – EMPLOYEES EARNING SALARY UPTO RS.25,000 ARE EXEMPTED FROM PAYMENT OF PROFESSION TAX W.E.F 01.04.2023

Read More