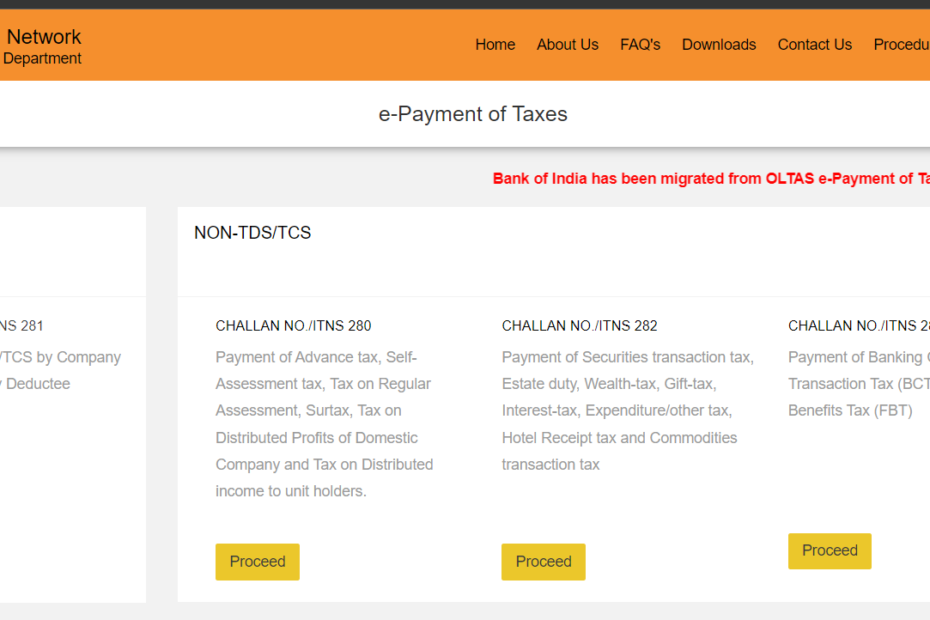

Step # 1: Visit the website https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Step # 2: Select CHALLAN NO./ITNS 280

Step # 3: Fill in the Details

Precautions to be taken while filling the Challan

a) Assessment Year : If you are paying advance tax for the Financial Year 2022 – 2023 then select Assessment Year as 2023 – 2024

b) Fill in all the mandatory details

c) Once you start the process complete it immedietly since the website has a time limit for completion

Step # 4: Verification Page

Verify the particulars in this page before proceeding for payment.