[A] As per Section 206C(1F)

(1F) Every person, being a seller, who receives any amount as consideration for sale of— of the value exceeding ten lakh rupees, shall, at the time of receipt of such amount, collect from the buyer, a sum equal to one per cent of the sale consideration as income-tax.

(i) a motor vehicle; or

(ii) any other goods, as may be specified by the Central Government by notification in official gazette.

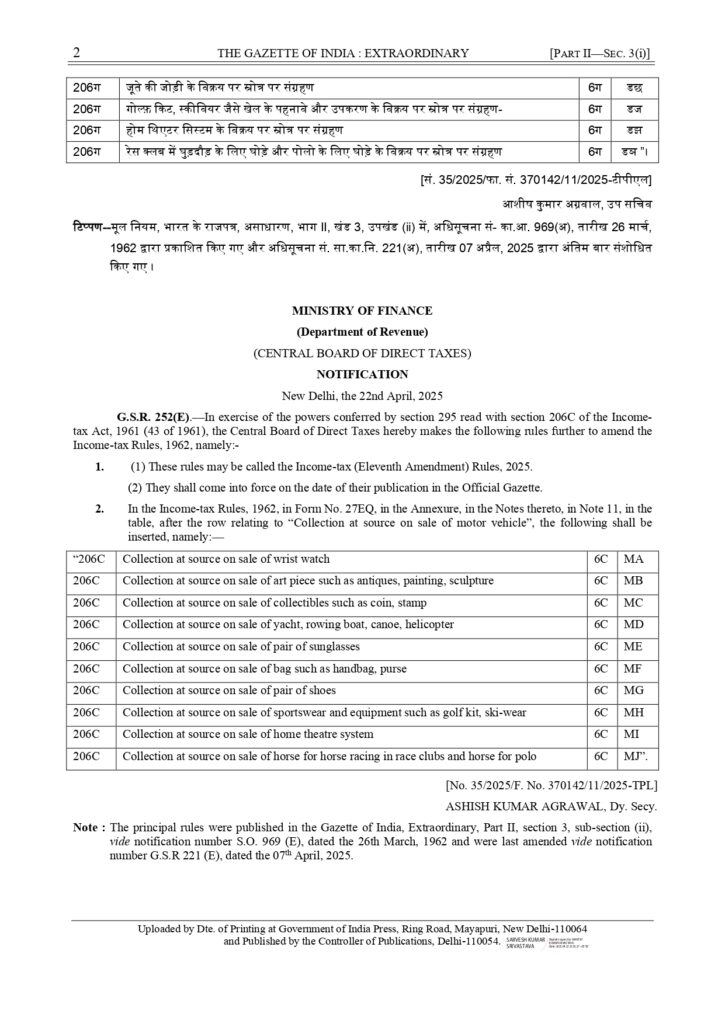

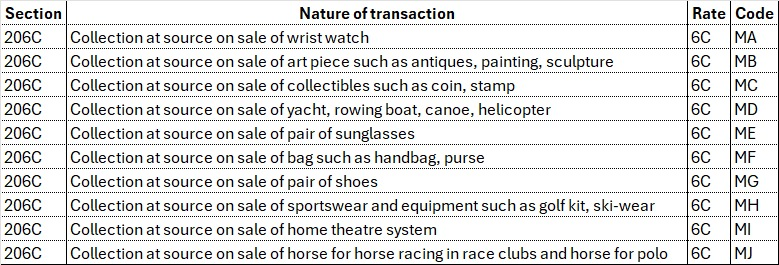

[B] NOTIFICATIION HAS BEEN ISSUED NOW BY THE CENTRAL GOVERNMENT

Till 21st of April only motor vehicles were covered under this provision, now the following are also covered :

[C] APPLICABLE FROM 22.04.2025

[D] Applicable only if the Sale Value exceeds ₹10,00,000