Mr. Prakash inherited a property in Bengaluru, which was bought by his father before his father’s demise. I know most of you may be wondering: Is there a tax on inheritance, and should one plan for it? The answer is no—there is no tax on inheritance.

However, imagine a situation where Prakash rents out this property and starts earning an income of Rs. 3,60,000. In addition to this, he is also employed at a software company, earning a salary of Rs. 15,00,000.

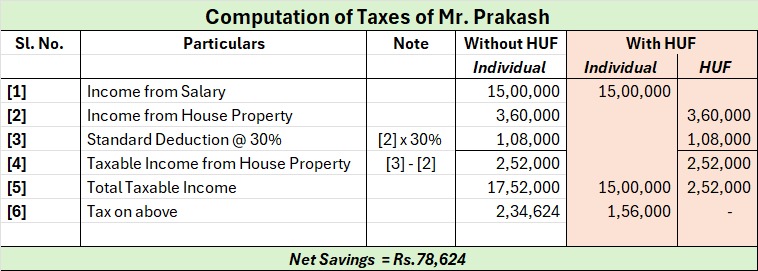

If it were just his salary income, he would pay a tax of Rs. 1,56,000 under the New Regime.

With the additional rental income, his tax liability increases to Rs. 2,34,624, resulting in an additional tax of Rs. 78,624.

What if I told you that there is a way to save this additional tax?

Any property (immovable or movable) inherited by a Hindu individual forms part of the property of a Hindu Undivided Family (HUF). This is considered a separate legal entity in the eyes of the law. Therefore, the rental income is actually the income of the HUF, not the individual.

Since the income is below the taxable limits (considering the basic limits & standard deduction), there will be no taxes.

Let me know your thoughts on this.