Steps to pay Advance Tax.

Step #1: Login to the income tax portal. www.incometax.gov.in

In case you don’t have the password with you handy please contact us and we will share the same with you.

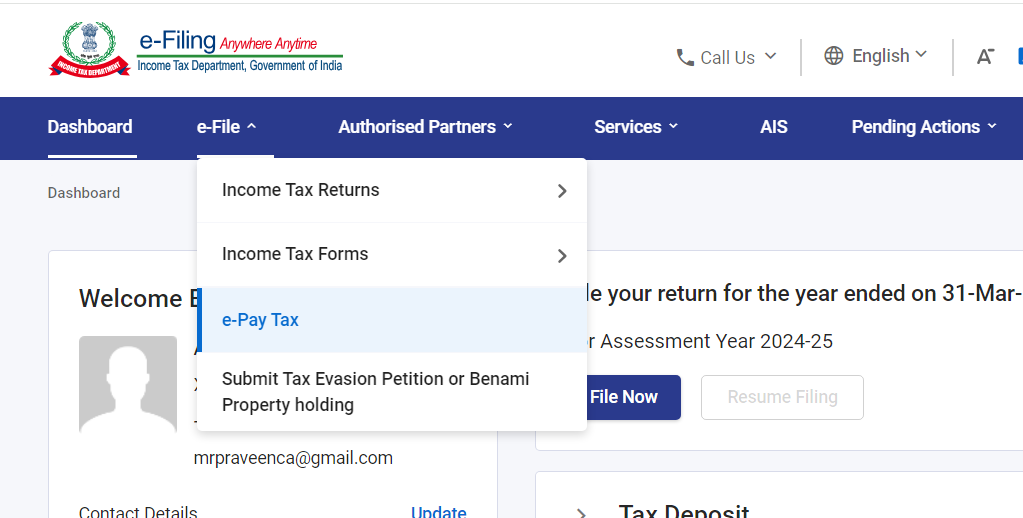

Step # 2: Go to e-File –> click on e-pay Tax

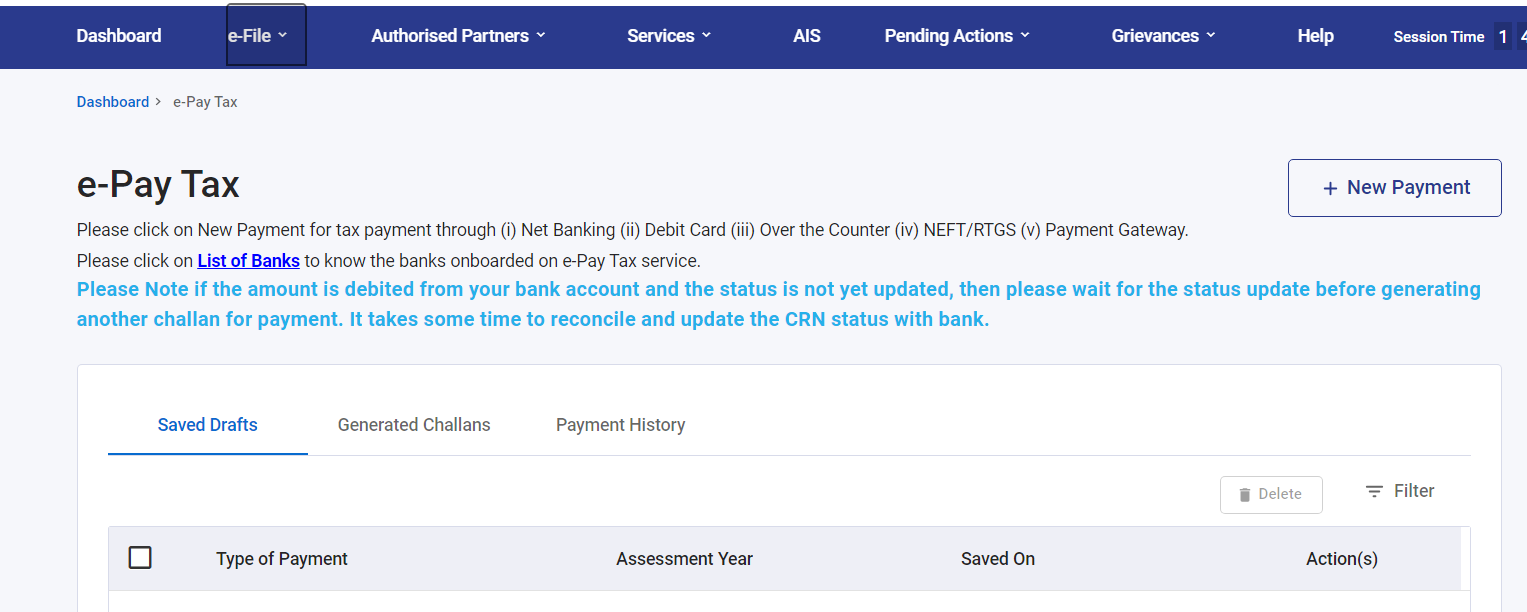

Step # 3: Click on + New Payment

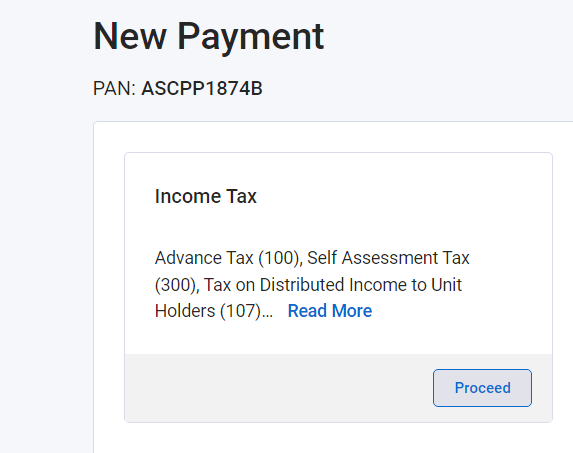

Step # 4 : Click on Proceed in the Income Tax Block

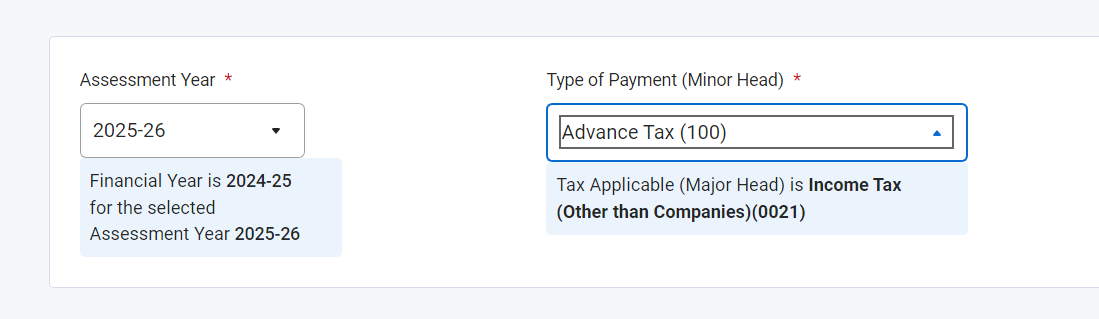

Step # 5 : Select Assessment Year : 2025 – 2026 and Type of Tax : Advance Tax (100) & then click on Continue

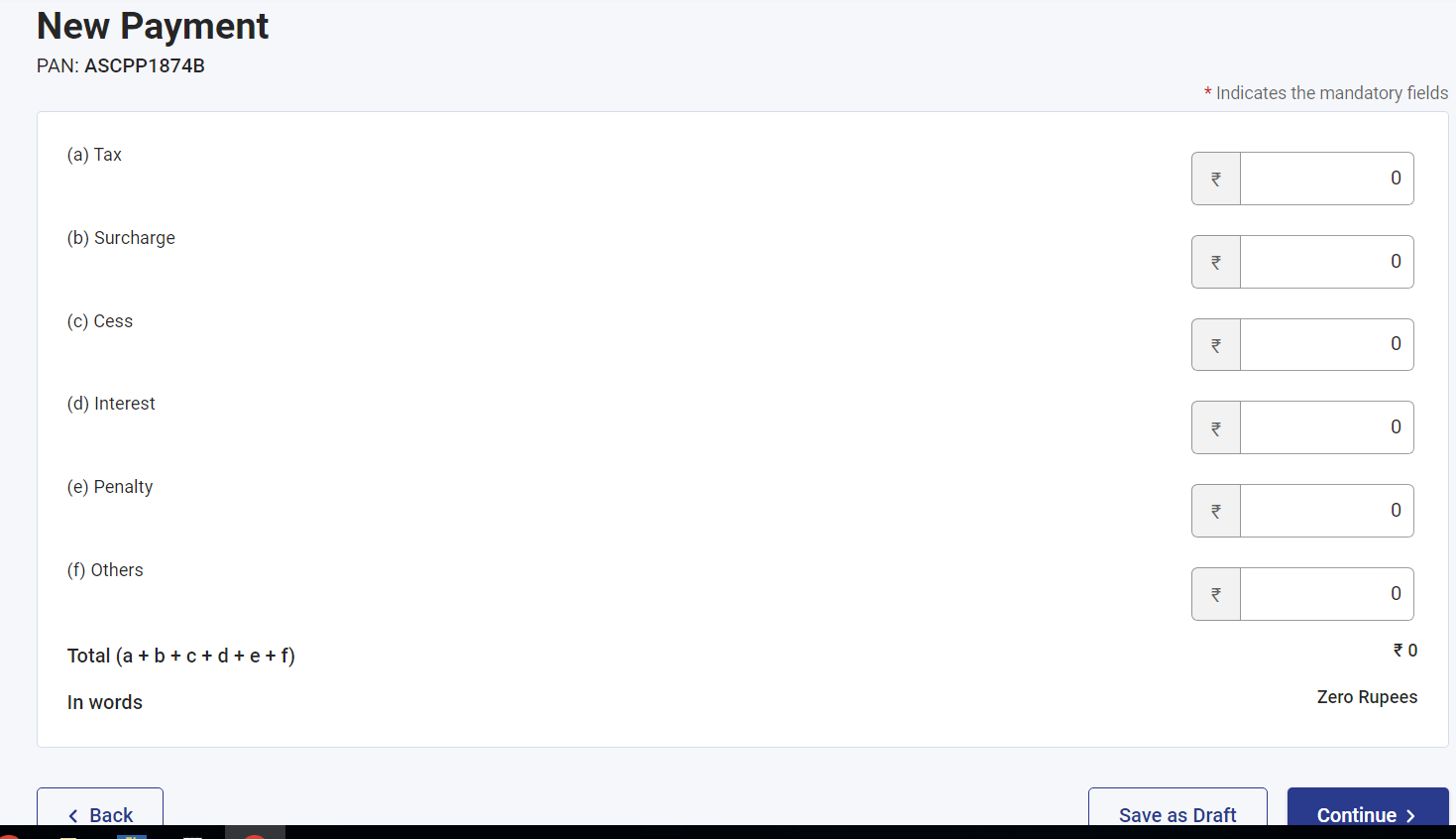

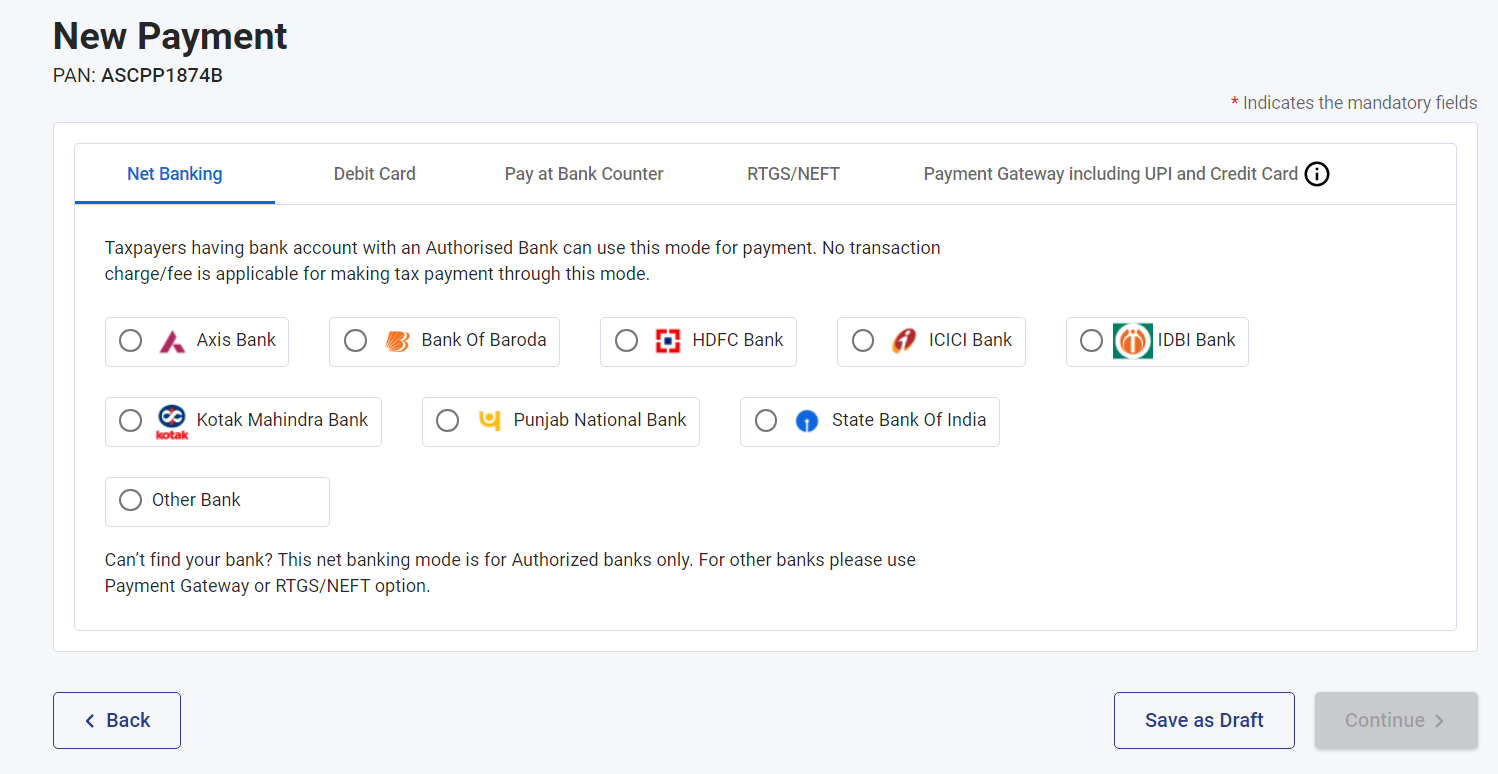

Step # 6: Mention the amount of tax you want to pay and click on continue.

HOW MUCH TO PAY?

1st Installment – July 15th – 15%

2nd Installment – September 15th – 45% Less: advance tax already paid

3rd Installment – December 15th – 75% Less: advance tax already paid

4th Installment – March 15th – 100% Less: advance tax already paid

Amount of Advance tax to be paid will be computed based on your Profit from business, Capital gains, house property income & other income. TDS / TCS may be adjusted.