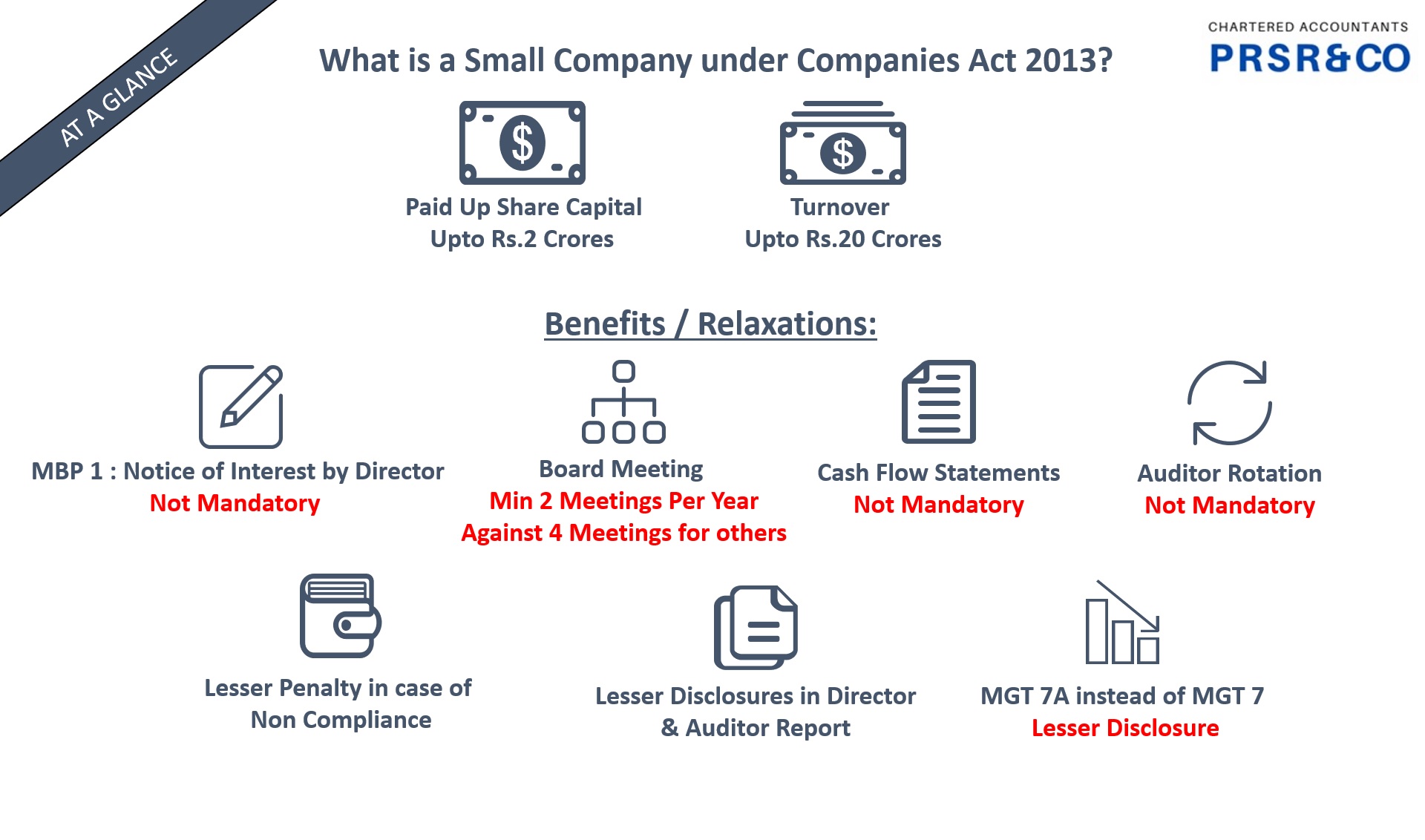

Firstly, what is a Small Company?

The concept of small companies was introduced by the companies act, 2013 for the first time. According to the Act some companies are termed as small companies based on their capital and turnover for the purpose of providing certain relief/exemptions to these companies.

| Upto 31.03.2021 | From 01.04.2021 onwards |

| Paid up Share capital upto Rs.50 Lakh Rupees & Turnover upto Rs.2 Crore Rupees | Paid up Share Capital upto Rs.2 Crores & Turnover upto Rs.20 Crores |

To qualify as a Small Company, a Private Company requires to full fill both of conditions prescribed above. Further, a Company is NOT a Small Company if:-

- It is a Public Company;

- It is a Holding of another company.

- The company is a subsidiary of another company.

- The company is a Section 8 Company.

- It is a company governed by any Special Act like Banking company

Benefits / Relaxations provided to a Small Company:

MBP 1: Disclosure of interest in other entities by a Director – Not Mandatory

Every director needs to disclose their interest in other entities at the first board meeting of the company every financial year. This condition is not mandatory in case of a Small Company

Board Meetings:

Every company is supposed to have 4 board meetings in one financial year, this is reduced to 2 board meetings in case of small company. However, the gap between such 2 board meetings shall be more than 90 days

Cash Flow Statements:

Financial statements generally throughout the world consists of Balance Sheet, Profit & Loss Account and Cash Flow Statements. Cash Flow statements are not mandatory for small companies.

Rotation of Auditors:

Under Section 139(2) auditors of the company needs to be changed every 5 years in case of individual auditors and after 10 years in case of auditor firms. For small company this section has been exempted.

Lesser Penalty in case of non compliance:

It’s a well know fact that the penalties under the companies act are huge. However, in case of small company the penalties are capped to Rs.1 Lakh per director and Rs.2 Lakh for the company.

Remuneration details in the annual returns:

Small company need not give out detailed remuneration drawn by the directors. Only aggregate amount of remuneration drawn can be disclosed.

Exemptions in Audit Report :

Small company are not required to report on internal financial controls with reference to financial statements and the operative effectiveness of these controls in the audit report.

Annual returns in MGT 7A :

Every company needs to file their annual returns in MGT 7, in case of small company MGT 7A can be filed which needs lesser details comparatively.